Current supplies

of nuclear fuel for power

reactors designed

in Russia

Current supplies

of nuclear fuel and

components in cooperation

with AREVA

Number of

units

Share of national

nuclear power

capacity

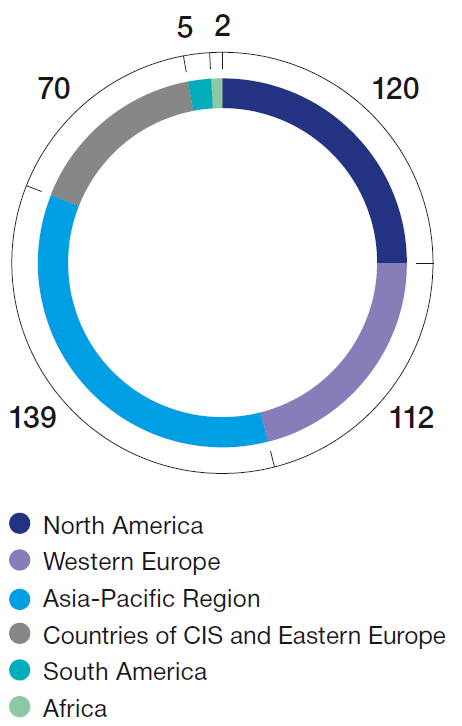

The majority of operating power units are located in Asia-Pacific region, North America and Western Europe. At the moment 57 power units are under construction in fifteen countries, including seven in Russia.

Fabrication Market

At the moment, more than 80% of the world reactor fleet consists of light water reactors (LWR) segment, including PWR, BWR and VVER reactors. It is expected that within the next 10 years LWR will amount to about 90% of new reactors put into operation.

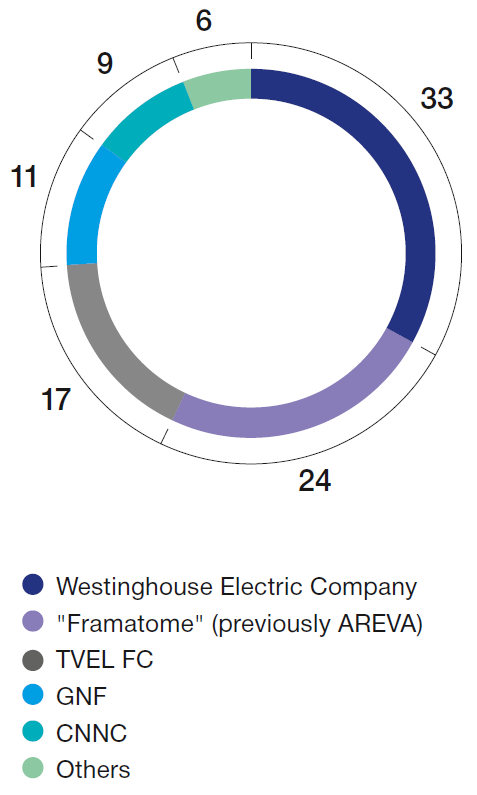

Major foreign manufacturers of fuel for light water reactors are located in USA, Western Europe and Japan:

- Framatome (previously AREVA NP, 75% share belongs to EDF) - BWR and PWR;

- Global Nuclear Fuel (joint venture of GE и Hitachi) - BWR;

- Westinghouse (till the end of 2017 owned by Toshiba) - BWR, PWR and VVER.

TVEL Fuel Company is the main supplier of fuel for reactors of Russian design, as well as it is sufficiently competent to produce nuclear fuel for PWR and BWR reactors and its components from reprocessed uranium (in cooperation with Framatome), and pellets for PHWR and BWR reactors. TVEL JSC elaborated its own in-house design of FA for PWR reactors - TVS-K, which is under the pre-test assembly program.

Main events of the nuclear fuel fabrication market in 2017:

- transition of the reactor and fabrication business of AREVA Group under control of EDF, the energy company from France;

- restructuring of Westinghouse, conducted in accordance with Chapter 11 of the US Bankruptcy Code, as a result of which the company will focus on nuclear fuel fabrication and engineering services.

Uranium Conversion and Enrichment Markets

In 2017, the price for separative work unit (SWU) continued its decline which began in 2011. By the end of 2017, the spot market price dropped below USD 40 per SWU. This is due to the surplus capacity and presence of significant nuclear fuel reserves in various forms that resulted in excess of conversion and enrichment services over the current demand in the market.

However, in anticipation of greater demand in a long-term perspective, several companies have chosen to modify their facilities and replace outdated plants with more modern and efficient ones:

- The French company Orano (known as AREVA NC until 2018), which consolidated the business of AREVA group in terms of uranium mining, conversion and enrichment, completed the construction of the new conversion plant Comhurex II and the new enrichment plant Georges Besse II.

- URENCO increased the capacity of its plant in USA and closed a series of outdated sites in terms of technology in its enrichment plants in Europe.

- Striving for self-sufficiency in products and services throughout the entire nuclear fuel cycle, China is increasing its production capacity for conversion and enrichment with a focus on the development of the reactor fleet in the country: production capacities on the conversion exceeded 10 thousand tons U/year, enrichment – reached the value ~6 million SWU/year.

Diagram 1

Front End Nuclear Fuel Cycle Market Growth Outlook

Front end nuclear fuel cycle market outlook depends on the current state of the reactor fleet and periods of its operation, plans for construction of new units, as well as the reserves of FE NFC accumulated by various market players. According to different scenarios in 2030 outlook, the nominal capacity of the global reactor fleet will increase, the difference is in growth rate.

Furthermore, in 2017 the country markets of nuclear power changed their long-term prospects. South Korea, which was seen as one of the growth drivers of the world’s nuclear power, set a course toward abandoning the construction of new nuclear power plants and extending the operating time of the existing reactors after reaching their design deadlines. At the same time at the end of 2017 France decided to postpone its plans to reduce the share of nuclear power in the national energy balance to 50% starting from 2025 to a more distant future.

Taking into account the above, it is expected that by 2025 the nominal capacity of the global nuclear reactor fleet will grow insignificantly: from the current 390 GW up to ~400 GW. By t 2030 we can expect the capacity to grow up to ~450 GW.

Position of TVEL Fuel Company in the World Market of the Front End of Nuclear Fuel Cycle

TVEL Fuel Company is one of the global leaders in nuclear fuel production. The Company's share in the global market of fuel fabrication in 2017 reached ~17%*. TVEL Fuel Company jointly with TENEX JSC provides a significant part of the needs of foreign design reactors in uranium enrichment services.

TVEL Fuel Company is sufficiently competent to produce and supply fuel and its components for all types of the existing Russian reactors (VVER, RBMK, EGP, BN), light-water western-design reactors (PWR and BWR), as well as fuel components for western-design pressurized heavy water reactors (PHWR). The Company successfully manufactures nuclear fuel from reprocessed uranium (in cooperation with Framatome (previously AREVA NP)) in compliance with the European regulations for manufacturing technology and the products manufactured. TVEL Fuel Company elaborated the in-house design of FA for PWR reactors - TVS-K fuel.

Diagram 2

Table 3

Indicator | Value |

|---|---|

Number of reactors running on Russian-made fuel, ea. | 72 |

NPP units in operation, worldwide | 448 |

NPP units under construction, worldwide | 57 |

Countries with NPPs under construction | 15 |

In recent years alongside with the increasing pressure on European NPPs operators, it is widely spoken out on the issue of the necessity to reduce the energy dependence on Russia, to diversify supply sources; which can be used as a means of competition restraint.

Due to increased competition in the fuel fabrication market, the initiatives of TVEL Fuel Company on improvement of technical and economic features of fuel, making TVEL FC products more attractive for its customers both on traditional fuel market for Russian-design reactors, and on the fuel market of Western-design PWR reactors, are extremely important.